Description

1) Why this matters

In Somalia, mobile money (EVC/ZAAD and others) is the backbone of daily transactions. Criminals target OTP codes, run SIM-swap scams, and spoof customer care to drain wallets or lock you out.

2) The main threats (plain language)

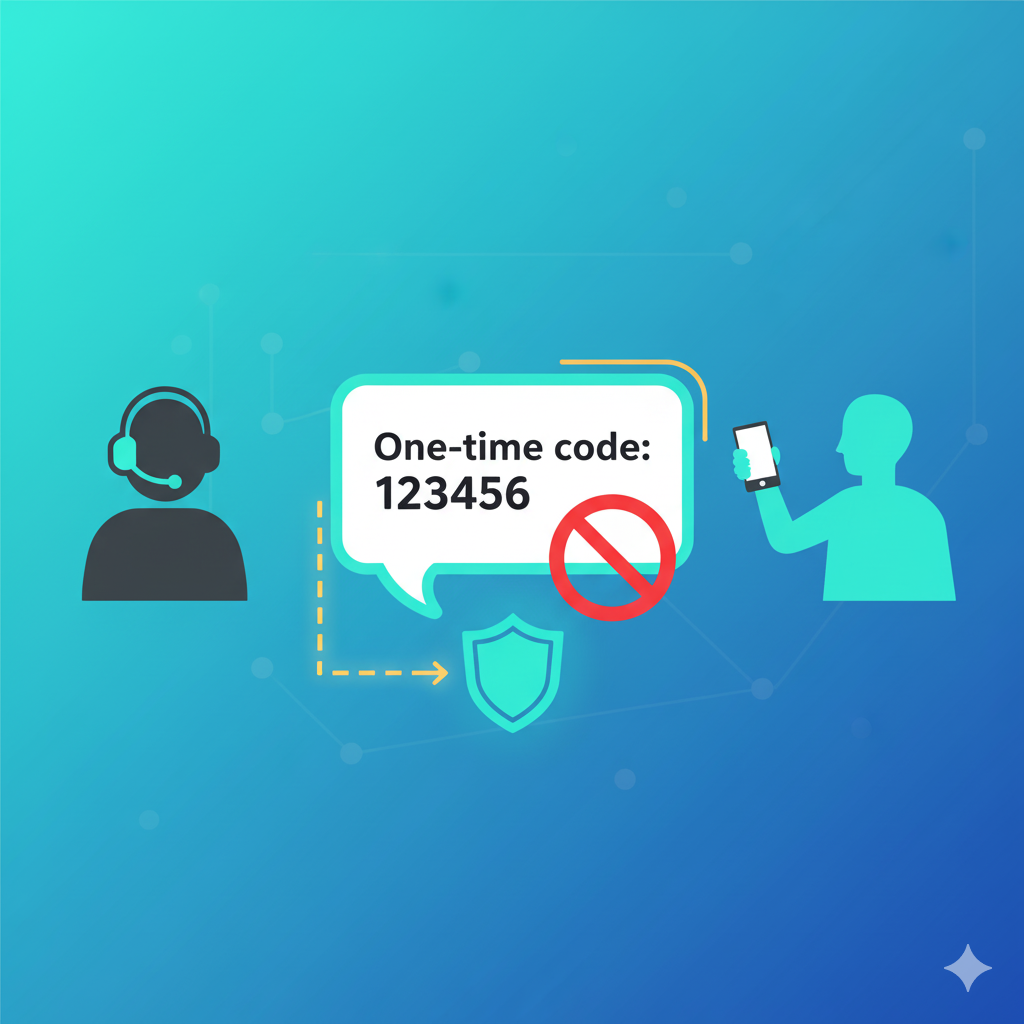

OTP/Code harvesting: “We sent money by mistake—share the code to reverse.”

Fake customer support: Impersonated telecom agents ask you to “verify” your number.

SIM-swap: Attackers socially-engineer the operator into issuing a new SIM for your number.

Malicious links/apps: Fake updates or APKs capture your SMS/notifications.

Account-sharing: Family/friends reuse your PIN or handle your phone; codes leak.

3) Red flags

Calls/SMS asking for PIN, OTP, or reset codes (legitimate agents never ask).

Urgency or threats (“service will be cut off in 1 hour”).

Requests to install unknown .apk files or share a remote-control code.

Numbers that look similar but are off by 1–2 digits; social accounts with few followers.

4) Prevention—what to set up today

Strong wallet PIN (not birthday; change regularly).

Separate device lock (6-digit code or biometric) + disable lock-screen SMS previews.

PIN-protect your SIM (SIM PIN) and ask your operator for extra identity checks on SIM replacement.

Never share codes—teach family and staff.

Install from official stores only; keep OS and apps updated.

Password manager + unique passwords for related email/social accounts.

2FA everywhere possible (authenticator app preferred over SMS).

5) If you suspect compromise

Freeze the wallet: call your telecom from a different phone; request immediate lock.

Change wallet PIN; rotate email & social passwords; enable 2FA.

SIM-swap? Visit a retail point with ID to reclaim your number; demand notes on the account.

Check transactions and lodge disputes quickly; time is critical.

Malware check: uninstall unknown apps; scan with reputable AV; update OS.

6) Safe habits for families & CSOs

Create a “money safety” rulebook (who can request transfers, how to verify).

Dual approval for large transactions (call-back using saved official numbers).

Quarterly refresher with examples of real scams seen in your area.

Keep a paper list of official support numbers (don’t rely on web links in messages).

7) Reporting pathways (practical)

Telecom wallet support: Official hotline/retail outlet; ask for case reference.

Bank partner (if linked): Freeze/alert compliance.

Organization: Notify finance + security focal points.

Law enforcement: Cybercrime desk where available; provide call/SMS logs.

8) Awareness snippets (reuse)

SMS/WhatsApp: “Never share OTP or wallet PIN. No operator asks for codes. Verify by calling the number on the operator’s website.”

Poster/Banner: “Think before you verify—agents never need your OTP.”

9) Minimal policy controls (institutions)

Wallets used for work must have named custodians and 2-person approval.

Maintain SIM inventory; SIM changes require manager sign-off.

Incident playbook: numbers to call, how to freeze, who to notify.